Do You Need Liquor Liability Insurance for Your Event?

As an event organizer, there are many factors that go into preparing for an event. Ensuring the safety of both you and the guests should

Starting at: $79

When it comes to showcasing your business at an event, the last thing you want to worry about is the hassle of buying one-day event insurance to meet requirements set by the organizer. ESP Specialty has a quick and easy solution to this problem with our vendor liability insurance portal. Here, customers can purchase coverage within a matter of minutes and receive their certificate immediately.

ESP collaborates with clients participating in events of any scale, from small mom and pop craft fairs to massive 100,000+ attendee expositions. Our team will tailor your policy to fulfill all requirements and assist in reducing risks for you and your business.

Coverage is underwritten by our AM Best A++ rated carrier partner through our risk purchasing group, SHEL. With ESP, you receive comprehensive coverage at the most competitive rate in the special event liability and vendor event liability marketplace. Count on us to safeguard your financial interests with a tailored policy that meets contractual requirements and shields you from unforeseen risks.

Go Ahead, We Have You Covered!

Starting at: $79

General Liability insurance protects against claims related to third-party bodily injury and property damage. Our standard General Liability coverage includes a blanket additional insured endorsement, enabling you to designate the manager, lessor, or owner of your vendor or trade show event venue, as well as the city or local municipality, as additional insured parties at no additional cost to fulfill contractual obligations.

Standard Program Limits:

General Liability Aggregate $2,000,000

GL Products/Completed Operations $1,000,000

GL Personal/Advertising Injury $1,000,000

Each Occurrence $1,000,000

Damages to Premises Rented to You $100,000

Medical Expense Limit: $5,000

Blanket Additional Insured: Included (as required by written contract)

An endorsement to the general liability policy that waives the insurance carrier’s right to seek compensation for losses from a negligent third party after paying a out a claim. May be included for an additional premium when required by written contract in favor of the manager, lessor, or owner of your event venue as well as the city or local municipality.

An endorsement to the general liability policy that designates the coverage as primary and non-contributory over other insurance policies held by the policy holder in favor of additional insured entity. May be added for additional premium when required by written contract in favor of the manager, lessor, or owner of your event venue as well as the city or local municipality.

Liability coverage that sits on top of the base $1 million per occurrence / $2 million aggregate general liability limits to fulfill higher limit requirements mandated in contracts. Excess liability limits up to $10 million available for additional premium, subject to underwriter approval offline.

As an event organizer, there are many factors that go into preparing for an event. Ensuring the safety of both you and the guests should

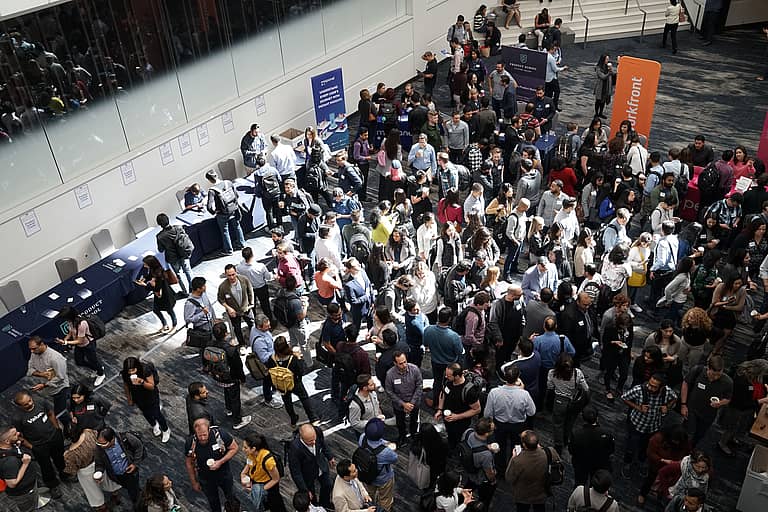

With more than 13,000 events in the United States each year and over 20,000 hosted around the world, trade shows are big business. It’s hard

No matter how much time you spend planning an event, you can’t account for everything. The keynote speaker may miss a flight and their speaking

ESP Specialty Insurance Brokerage operates nationwide as an

insurance broker and program administrator, exclusively developing

and managing insurance product lines for A+ rated carriers for over 10 years.

Powered by Getfused